Your credit score extends beyond the mere approval of credit cards or loans. Various entities utilize it in setting home and car insurance rates, deciding your employability, and approving apartment rentals.

A common misconception among many is that the exclusive method to build a credit score involves using a credit card, which is not at all accurate.

Given the fact that not everyone has access to a credit card, I’ve put together this list of ways to develop credit without dependence on credit cards.

8 Techniques to Develop Credit Without Utilizing a Credit Card

While credit cards can be effective tools for building credit, they may also cause problems if not handled correctly.

If you’ve encountered situations where you had to clear credit card debt, faced issues with a credit card, or simply wish to avoid these scenarios altogether, consider these alternative paths to build credit:

1. Gain ‘Credit’ for Utility Bill Payments

Experian, one of the three significant credit bureaus (and indeed the largest), offers the Experian Boost program to help you bolster or enhance your credit.

You can elevate your credit score by paying utility bills via Experian Boost. The eligible bills include Netflix, Hulu, HBO, other streaming services, your phone bill, your electric bill, and more.

There are certain limitations to this. Firstly, the credit enhancement only appears on your Experian credit report, not those issued by Equifax and TransUnion. Secondly, consistent late payments on bills won’t see much improvement. Lastly, the program aims to boost an existing credit score – its benefits for someone with no credit are uncertain.

Experian Boost is free of charge, so there’s no risk in using the service and cancelling later. Visit their page for more details.

2. Opt for a Credit Builder Loan

Credit builder loans serve as unique tools for individuals to build their credit and amass more money. If you have little to no credit or poor credit, accessing credit to improve your score might be challenging.

Here’s how credit builder loans work:

You make monthly payments to the credit builder company.

The company sets this money aside while reporting each payment as on-time to the credit bureau.

At the end of the loan term, you receive your paid money back, minus any fees and interest charges.

Firms like Self offer credit builder loans with monthly payment options ranging from $25 up to $150, all over 24 months.

Cleo, another credit-building option, is a budgeting app that assists you in building credit.

3. Have Your Rent Reported to Your Credit Bureau

Certain companies will report your timely rent payments to one or more of the three major credit bureaus.

Joining forces with such a company allows you to build credit simply by paying your rent.

Firms like Rent Track and PayYourRent collaborate with property owners to accept rent payments which are then reported to the credit bureau.

Another approach to having your rent payments reported to the credit bureau involves using the Bilt Mastercard to pay your rent. This card not only allows you to pay rent but also rewards you for doing so.

4. Build Credit By Bill Payments

StellarFi provides a bill pay card where you connect all your auto payments, like streaming services, utility payments, and more.

StellarFi ensures all bills are paid automatically and timely, and these payments are reported to the three main credit bureaus.

The payments to StellarFi are automatically authorized from your linked bank account. StellarFi offers three different membership plans, starting at $4.99 per month.

5. Become an Authorized User

Becoming an authorized user on someone else’s credit card is another way to build credit.

You’d likely agree not to have access to the card and preferably become an authorized user on a card belonging to a close relative, such as a parent.

If they responsibly use their cards and maintain a high credit score, associating your name with one of their cards could benefit you.

6. Take Out a Personal Loan

Considering a personal loan can also be an option if needed. Personal loans have limited funds and don’t revolve like a credit card, thus once paid off, it doesn’t pose the risk of accruing more debt.

Discussing this possibility with your local bank or credit union could be beneficial. You might even take out the loan and save the money, making loan payments from this savings account.

7. Pay Your Existing Loans Timely

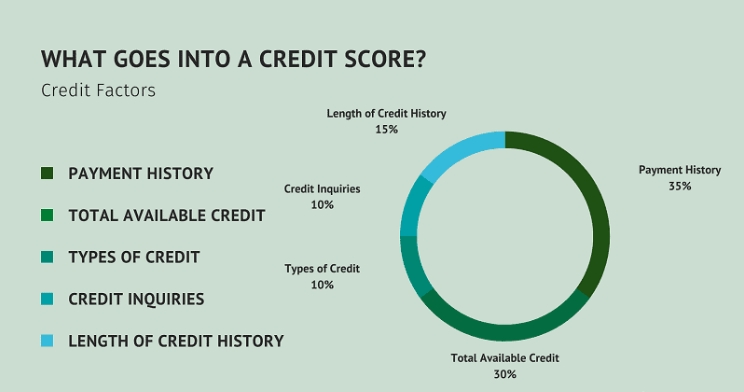

If you possess existing loans, such as student or personal loans, make sure to pay them on time as this accounts for over one-third of the weight in determining your credit score.

Setting up auto-payment from your checking account can help if timely payments are challenging.

8. Think about a Car Loan

A car loan is another method to build credit without a credit card. It shows an ability to manage larger loan amounts and make payments on time.

Remember to set up automatic payments to ensure monthly loan repayments are made timely.

Credit Report Best Practices

In addition to the aforementioned credit-building techniques, adopting the following best practices can assist in maintaining an optimal credit score:

Regularly Check Your Credit Reports

Frequent checks of your credit report can notify you of inaccuracies or fraudulent activities that may damage your score. This also keeps your credit at the forefront, and what is measured tends to improve.

You can get a free annual copy of your credit report from www.annualcreditreport.com, which allows you to view and print your credit reports from Experian, Equifax, and TransUnion.

Make sure to review your report thoroughly and collaborate with each credit bureau to repair or remove any errors.

For more regular access to your credit report and score, consider registering with a credit score app.

Maintain a Low Debt-to-Income Ratio

Maintaining a low debt-to-income ratio is another way to ensure your credit score remains high.

To calculate your DTI, divide the amount of revolving debt you have by the total issued credit line amounts.

Experts recommend maintaining a DTI of no more than 30% for optimal credit score benefits from a DTI perspective.

However, other factors also affect how your credit score is calculated. Timely bill payments, an extensive history of efficient credit management, and having a balanced mix of credit types (i.e., loans and credit cards) will also aid in building your credit score.

Common Queries

What is the Fastest Way to Build Credit?

The quickest credit-building path likely involves using one of the secured credit strategies. This could be a secured installment loan (like a car loan), a credit builder loan, or a secured credit card. Immediate payment track records from these methods can help you build credit in the shortest amount of time.

On the opposite end, federal student loans can be slow due to their common payment deferral periods that can last for several years.

Can I Build Credit with a Debit Card?

Unfortunately, this isn’t possible because debit cards aren’t financing arrangements. They only provide access to the funds you have in a bank or credit union. Without payments to report to the credit bureaus, they don’t contribute to your credit score.

How Long Will it Take for me to Build Credit Using any of the Above Methods?

If you currently have no credit, expect at least a six-month period after implementing one of these strategies to start seeing results.

Before the credit bureaus can compute a credit score, you first need to show regular payment capability, which generally takes at least six months.

But even after six months, your credit score might remain low because a single loan has a limited impact. Typically, you won’t witness your credit score reaching the mid or upper-600s until you have at least two or three lines of outstanding credit with a payment history extending back 12 months or more.

Final Reflections

While using a credit card is one of the fastest and simplest ways to commence building credit, it’s comforting to know that it’s not the sole option.

If obtaining a credit card poses a challenge or you simply prefer not to use one, consider trying one or more of the alternative credit-building methods discussed above. Though it may take time, your diligence will pay off.

Lastly, if you haven’t ordered a free copy of your credit report yet, that’s an excellent starting point.