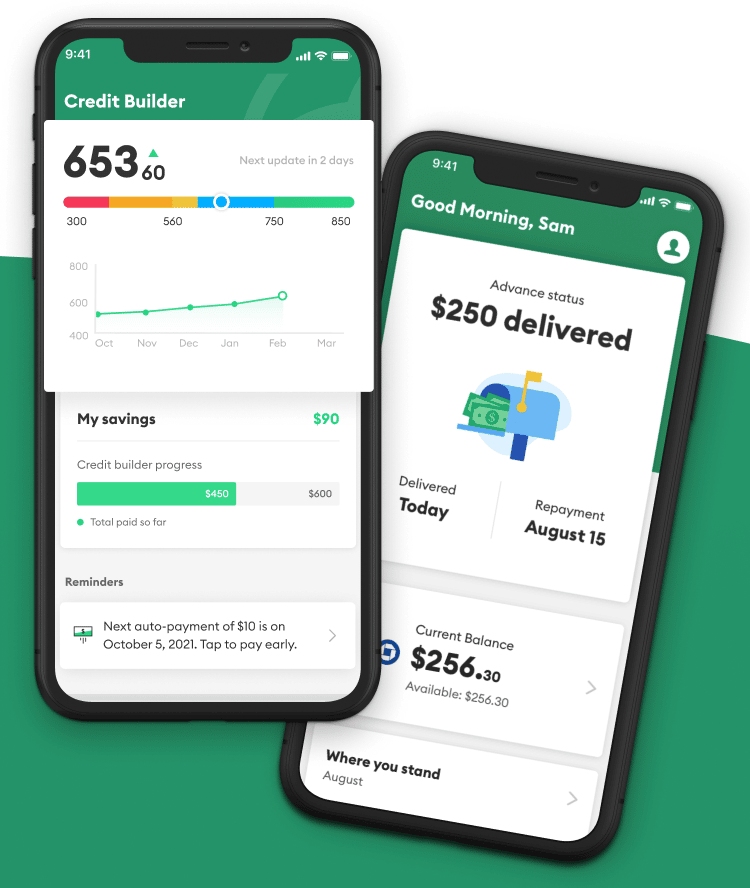

Dave is a finance application backed by FDIC insurance via its partnership with Evolve Bank and Trust. It has been devised to aid individuals in managing their finances with an exclusive cash advance service named ExtraCash. This feature can offer you up to $500 of cash without any interest charges.

Nevertheless, there are numerous other cash advance apps providing services similar to Dave’s. Although ExtraCash offers one of the highest cash advance limits (most apps limit at $200 or $250), one needs to establish a Dave checking account to qualify, and the fees are comparatively high.

Therefore, prior to signing up for Dave, it is imperative to explore other alternatives, as you may find a more fitting cash advance app. We have assembled a list of 8 apps akin to Dave to assist you in this process.

The distinguishing feature of Dave is its cash advance service, ExtraCash, that offers you a free cash advance of up to $500 devoid of any interest.

Depending on where you want the cash advance transferred (your Dave spending account or another account), the money can be made available within an hour. The borrowed amount will be recovered by Dave on your next payday.

Dave levies a $1 membership fee, and express transfers also incur fees. Additionally, when utilizing the Cash Advance feature, you’ll be prompted to tip which proceeds to Feed America. However, tipping is optional. Dave also incorporates other features like side hustle support and account monitoring.

8 Alternatives to Dave

Brigit Cost: $9.99 per month Cash Advance Limit: Up to $250 Highlight: Flexible repayment terms Established in 2017, Brigit does not offer a spending account unlike the Dave app. Instead, it synchronizes with your daily spending or checking account. To be eligible for a cash advance from Brigit, the linked account should have been active for at least 60 days, maintain a positive balance, and register a minimum of three recurring deposits from an identical source.

EarnIn Cost: No monthly fee Cash Advance Limit: Up to $100 per day Highlight: Daily cash advances The EarnIn app functions differently from Brigit and Dave. It begins by acquiring your pay schedule information.

Empower Cost: $8 per month Cash Advance Limit: Up to $250 Highlight: Auto-saving feature Empower has several features aimed at enhancing your financial condition, including a cash advance feature that allows borrowing up to $250 to be automatically repaid on your next payday.

Chime Cost: No monthly fee Cash Advance Limit: $20 to $200 Highlight: Appealing referral program Launched in 2013, Chime is a fintech banking app offering various services like checking accounts, early Direct Deposit, high-yield savings, fee-free overdraft, and more.

Varo Cost: $4-$15 per “spot” Cash Advance Limit: $20 to $250 Highlight: Attractive savings rate Varo’s online banking account includes a cash card and an automatic $20 “spot me” to cover overdrafts.

MoneyLion Cost: No monthly fee Cash Advance Limit: Up to $1,000 Highlight: High cash advance amount MoneyLion offers a banking account including Instacash advances of up to $1,000 with no fees or interest.

Branch Cost: Up to $4.99 per advance Cash Advance Limit: Up to 50% of your paycheck, or $500 maximum. Highlight: Works directly with your employer The Branch banking fintech allows you to have your paycheck directly deposited into your Branch banking account.

Conclusion

Before signing up for a cash advance app like Dave, it is crucial that you explore multiple options and find the one that suits your requirements the best.